Sir Leo Chiozza Money was born in Italy in 1870 to an Anglo-Italian father and an English mother. The family moved to England in the 1890s. He worked as a journalist, wrote books on economics and earned a reputation for incisive statistical analysis. He worked for Lloyd George as a parliamentary secretary, before becoming a junior minister towards the end of the war. Born Leone Giorgio Chiozza, he added “Money” to his name, making it less foreign for English speakers to pronounce. For those among you who think “Sir Money” is a wind-up, visit this Wikipedia page.

The years around the turn of the 20th century were filled with books and other publications. Titles included British Trade and the Zollverein Issue (1902); Elements of the Fiscal Problem (1903); Riches and Poverty (1905). Money was an unswerving advocate free trade, arguing that imperial powers could not afford to give tariff preferences to the colonies, because the colonies would not be able “…to supply them (the imperialists) in sufficient quantities to support our industries and people.” It makes you wonder how poor countries survived before their resources were discovered and exploited by rich invaders.

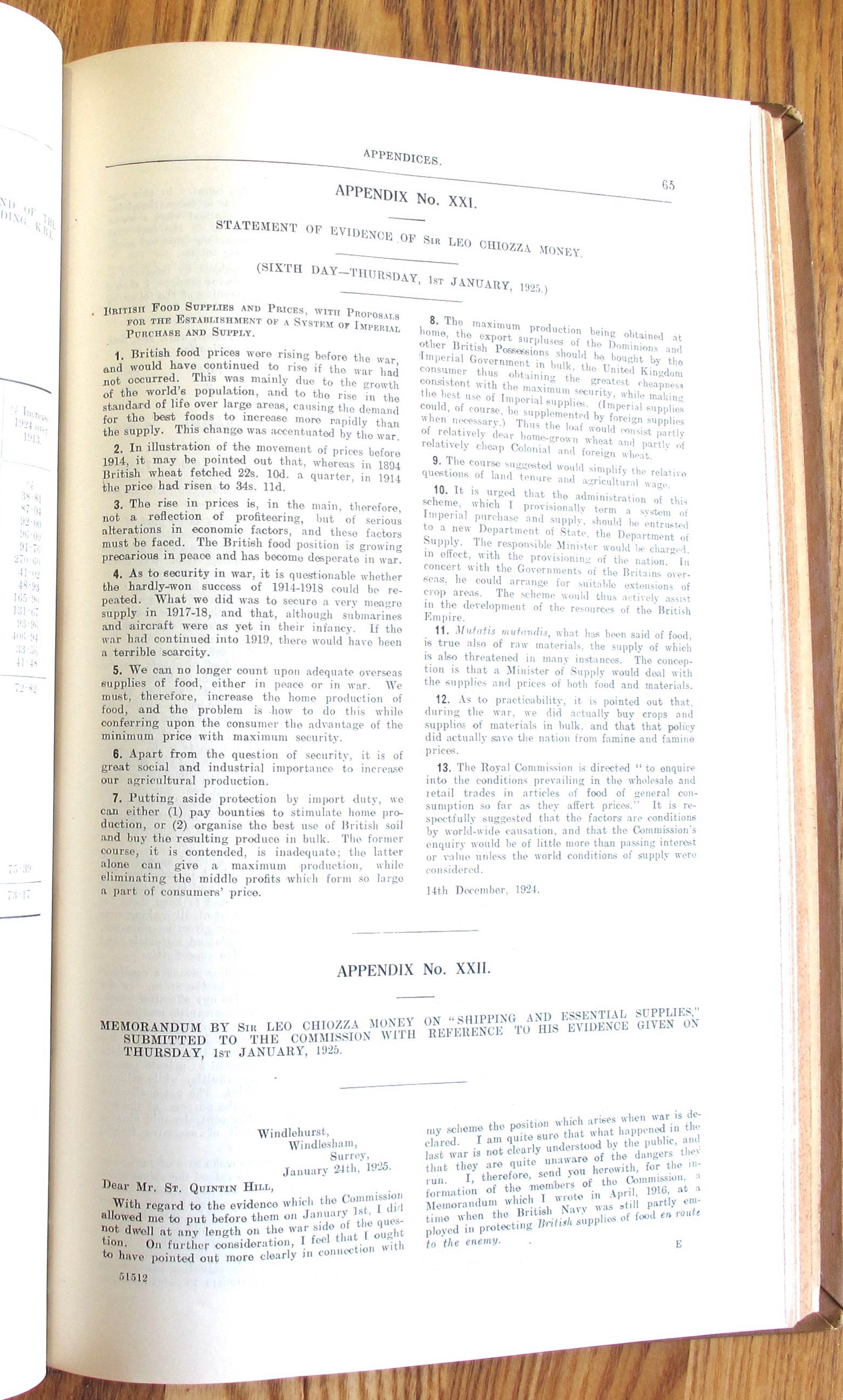

Money’s evidence to the commission started (para 1) by identifying a growing world population and higher standards of living as a cause of rising prices. War has a very powerful impact on inflation in its own right, not least due to its disruption to transport and commercial activity in general. Money cites the historic rise of British wheat prices, (para 2) from 22 shillings a quarter in 1894 to 34 shillings a quarter in 1914. This inflation is judged to be serious rather than “profiteering” (para 3) and Money describes the situation as “precarious in peace and desperate in war.”

The UK was lucky to get through the first world war, when its supply chains came under fire (para 4) from submarines and other vessels that were being developed. Britain could not and should not expect to feed itself on imported food at peace or at war (para 5). This is a valid point, coming as it does with a call to renew the country’s agricultural system. More than just a good thing, (para 6) it is “… of great social and industrial importance.” He develops this theme (para 7) and argues that scaling up agricultural production will remove middlemen from supply chains and lead to cheaper retail prices. Nice try, but wide of the mark. Likewise, his proposition that surpluses from British dominions and possessions (para 8) should be bought up for sale in the UK begs a number of questions, such as who decides what is surplus or not. The notion that a loaf might be made up of “partly of relatively dear home-grown wheat and relatively cheap Colonial and foreign wheat…” is fanciful at best. As is the suggestion that Money’s plan would resolve issues around land tenure and the agricultural wage (para 9).

Money proposes a ministry to manage the price components for the nation’s food supply (para 10). While the government did indeed establish a food ministry as Europe slipped back into war, its purpose was to ensure there was food to eat rather than numbers to crunch. Like many other economists, Money is quick to point out that what applies in one sector of the economy can probably be re-used and applied elsewhere (para 12). It is also an efficient way of spreading any policy shortcomings from one sector to another.