In the wake of changes brought about by the revolution, the focus of the French economy shifted. The 18th century was a time when international trade was operating in what people used to call triangular trading patterns. Starting in the UK or a European port, ships would sail to ports on the African coast, where they collected shipments of slaves before leaving for the Caribbean. Many died aboard ship, others within days or weeks of arriving. The ships stayed tied up while they were loaded with tea and sugar before returning to London, where these luxury products were taxed and sold on.

Carrying food safety is a bit like a fairground ride: it appears chaotic at first sight, but the staff who have to work on the rides develop very finely tuned responses to changes in their work.

There is a more than a touch of narrative enthusiasm surrounding the lives and work of such industry demigods as Nicolas Appert; Louis Pasteur; Antoine-Augustin Parmentier. Many of the robust and worthy food industry leaders of the 19th century were also buried in the Parthenon, provided the body was not in an advanced state of decay. Legendary French family food businesses, just like their founders, have been long-lived, profitable and for those tourists who thought that Paris was as good as it gets, a source of wonder to passing visitors to France. There are many competent food companies working in obscure corners of la France profonde and a lot of them knock the parisians into a cocked hat.

Take a scrap of paper and start writing down a list of French firms. As you start looking for famous businesses and household names in towns and cities across France, you will find highly reputable companies with postcodes that spell out traditional landscapes rather than modernity. For me, the four generations of the Hénaff family come to mind: starting with very simple ingredients, they have a very small staff, but manage a huge production schedule. due to the efforts of third generation family member Jean-Jacques Hénaff. His core product is the canned Paté Hénaff, perfected at the Hénaff family’s manufacturing site in Pouldreuzic on the Breton peninsula. Should you like fungi, look up the Borde mushroom packing plant. All three generations were busy sorting and cleaning fungi, when I visited.

The tropical peasants who supply large quantities of almost dry fungi used to top up the sacks with ferrous waste to bulk up the weight loss in the drying stage. Nobody ever mentions the overweight sacks to the suppliers, for one very simple reason. So long as they carry on using scrap iron pellets, the metal shows up on a standard food industry conveyor belt. If the pickers change the material used to top up the sack weight, there is a risk that the substitution might not be detected in time, with potentially expensive litigation.

Elsewhere, in the south of France, spirit manufacturer, Matthieu Tesseire was politically active during the early 18th century. By 1720 the Tesseires had spotted the risk of a change of government, sold their land and sailed to the Caribbean, where nobody was challenged for their politics. The family devised a reliable and safe way of transporting sugar to metropolitan France, earning a fortune as they went. As the generations passed, they became increasingly argumentative and ongoing feuds within the clan finally pushed André Tesseire to restructure the business as a twenty first century corporate entity, in a despairing bid to prevent personal emnities from tearing up a multi-million cash cow into commercial confetti.

In the years leading into the 19th century, transport set operational ceilings for distribution systems, but once the age of steam was in motion, bigger load sizes and greater carrying capacities resolved a lot of the once-intractable issues.

Once in a while, somebody releases statistics or data that tells a complete story in figures alone. Take this example from the National Farmers’ Union (NFU) last week.

Once in a while, somebody releases statistics or data that tells a complete story in figures alone. Take this example from the National Farmers’ Union (NFU) last week.

There are a number of gaps in the human rights platform that cannot be allowed to go unchallenged. The first is that in eighteenth century France, it excluded women, which was more than a minor oversight. It means that where womens’ rights had prevailed, there were the beginnings of a more balanced society. But while womens’ voices were heard in occasional outbursts and as far away from the functions of government as could be managed, the bigger flaw in the liberal vision remains the exclusion of the planet and the natural world from future vision. There is no way that humanity can be left to destroy the planet’s resources from the highest levels of the atmosphere to the deepest recesses of the oceans. It is not just ironic that a species which claims the world’s resources for itself should make such a good job of destroying life on the planet, its own included. It is also extremely offensive, not least because of the high levels of coercion that the world’s rulers apply to those around them.

There are a number of gaps in the human rights platform that cannot be allowed to go unchallenged. The first is that in eighteenth century France, it excluded women, which was more than a minor oversight. It means that where womens’ rights had prevailed, there were the beginnings of a more balanced society. But while womens’ voices were heard in occasional outbursts and as far away from the functions of government as could be managed, the bigger flaw in the liberal vision remains the exclusion of the planet and the natural world from future vision. There is no way that humanity can be left to destroy the planet’s resources from the highest levels of the atmosphere to the deepest recesses of the oceans. It is not just ironic that a species which claims the world’s resources for itself should make such a good job of destroying life on the planet, its own included. It is also extremely offensive, not least because of the high levels of coercion that the world’s rulers apply to those around them. The opening weeks of the French revolution saw the drafting of a declaration establishing the existence of human rights and what each person was obliged to do to protect the same rights and privileges for their fellow citizens. These boundaries can only be determined by law. As we shall see later, there was no

The opening weeks of the French revolution saw the drafting of a declaration establishing the existence of human rights and what each person was obliged to do to protect the same rights and privileges for their fellow citizens. These boundaries can only be determined by law. As we shall see later, there was no We need to start somewhere and there is every sign that even exemplary revolutionaries will struggle with the idealistic aims of human rights: the planet comes off second best in the face of such the supposedly universal rights, as do flora and fauna the length and breadth of the planet. Having claimed the lion’s share of the world’s natural resources, the human revolutionary elite turned its attention to making a set of laws to withhold its new-found privileges from those who could possibly represent a challenge to future generations of global power brokers. The irony of this paradox is a heavy burden that is shared with nature in every corner of the globe: we have already seen some of the consequences in our atmosphere, our ocean depths and our chances of survival, but this is only this is only the beginning.

We need to start somewhere and there is every sign that even exemplary revolutionaries will struggle with the idealistic aims of human rights: the planet comes off second best in the face of such the supposedly universal rights, as do flora and fauna the length and breadth of the planet. Having claimed the lion’s share of the world’s natural resources, the human revolutionary elite turned its attention to making a set of laws to withhold its new-found privileges from those who could possibly represent a challenge to future generations of global power brokers. The irony of this paradox is a heavy burden that is shared with nature in every corner of the globe: we have already seen some of the consequences in our atmosphere, our ocean depths and our chances of survival, but this is only this is only the beginning. For France’s parliamentarians, 1993 ended with some progress, but without a readily identifiable outcome. To be sure, national legislation had got a better grip on the systematic abuses of commercial practice, but there remained a lot of work to finish before anyone would be able to say they had anything solid to show for it. The

For France’s parliamentarians, 1993 ended with some progress, but without a readily identifiable outcome. To be sure, national legislation had got a better grip on the systematic abuses of commercial practice, but there remained a lot of work to finish before anyone would be able to say they had anything solid to show for it. The

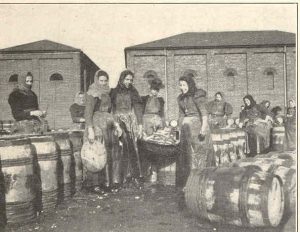

Scottish fishermen working in the North Sea from the from the 18th century onwards, adopted the cran basket as a measure of fish on the quayside; a full cran of herring weighed 56 stone and was usually spread across four quarter cran baskets. (56 stone = 56 x14 divided by 2,2 kilos) The quarter cran basket became a legalised trading measure in Scotland during the 19th century, followed by England and Wales in 1908.

Scottish fishermen working in the North Sea from the from the 18th century onwards, adopted the cran basket as a measure of fish on the quayside; a full cran of herring weighed 56 stone and was usually spread across four quarter cran baskets. (56 stone = 56 x14 divided by 2,2 kilos) The quarter cran basket became a legalised trading measure in Scotland during the 19th century, followed by England and Wales in 1908. The deck crew sort and gather the catch, most of it is herring, bound for the smokehouses. Before the quarter cran baskets are filled, they are moved to the unloading area on the deck. Once again, the skill of the basket weaver is put to the test: a quarter cran basket holds on average seven stone (7stone = 7×14 divided by 2.2 kilos) of fish. The baskets are topped with a solidly woven rim. They are unloaded using a small steam-powered crane and of specially shaped pair of clips to hold the basket until they land on the quayside with a gentle scrunching noise. Soon to be smoked as kippers, some of this catch would have been sent to London by train overnight, arriving just in time for breakfast at a gentlemens’ club.

The deck crew sort and gather the catch, most of it is herring, bound for the smokehouses. Before the quarter cran baskets are filled, they are moved to the unloading area on the deck. Once again, the skill of the basket weaver is put to the test: a quarter cran basket holds on average seven stone (7stone = 7×14 divided by 2.2 kilos) of fish. The baskets are topped with a solidly woven rim. They are unloaded using a small steam-powered crane and of specially shaped pair of clips to hold the basket until they land on the quayside with a gentle scrunching noise. Soon to be smoked as kippers, some of this catch would have been sent to London by train overnight, arriving just in time for breakfast at a gentlemens’ club. The NFU’s next director general is an experienced food industry management figure. Sophie Throup joins the National Farmers’ Union in May, bringing with her years of board level experience, notably as Head of Agriculture at Morrisons. Raised on her family farm in Yorkshire, her working life reflects her commitment to food production. “My roots have always been in agriculture, and I know how important this period of change is for the sector,’ she told journalists when her appointment was announced. NFU members have frequent problems when dealing with multiple retailers, since food producers are not automatically the supplier named on the documentation. This seemingly minor distinction makes an important difference, since food retailers will stone wall and refuse to engage with any party that is not explicitly named on the account details. Quite apart from being very frustrating, this can make some contracts unworkable. This may be a deliberate tactic used by the retailer, or it may be used to stress test a supplier. Time sensitive crops and activities are particularly vulnerable to such practices, since person or party that has to deliver the product has no way of knowing where the real problem arises. Retail logistics will often assume that all categories are time sensitive and place a 20-minute window on deliveries, particularly store deliveries, to keep sites moving, even if the products themselves are stable.

The NFU’s next director general is an experienced food industry management figure. Sophie Throup joins the National Farmers’ Union in May, bringing with her years of board level experience, notably as Head of Agriculture at Morrisons. Raised on her family farm in Yorkshire, her working life reflects her commitment to food production. “My roots have always been in agriculture, and I know how important this period of change is for the sector,’ she told journalists when her appointment was announced. NFU members have frequent problems when dealing with multiple retailers, since food producers are not automatically the supplier named on the documentation. This seemingly minor distinction makes an important difference, since food retailers will stone wall and refuse to engage with any party that is not explicitly named on the account details. Quite apart from being very frustrating, this can make some contracts unworkable. This may be a deliberate tactic used by the retailer, or it may be used to stress test a supplier. Time sensitive crops and activities are particularly vulnerable to such practices, since person or party that has to deliver the product has no way of knowing where the real problem arises. Retail logistics will often assume that all categories are time sensitive and place a 20-minute window on deliveries, particularly store deliveries, to keep sites moving, even if the products themselves are stable.