If there is so much money at stake, how strong is the case for accusing food manufacturers of Ultra Processed Foods (UPFs) of wilful distortion? The arrival of wall to wall processed foods in British aisles in postwar years has been accompanied by rising numbers of patients needing treatment for heart disease and diabetes. While the nation gorges on sugar, salt and saturated fats, there is a drop in foods that bring whole grains, let alone fruit and vegetables. Processing very finely divided ingredients allows fertilisers and other toxic residues to spread downstream through the food chain. More worrying is the uptake of UFPs in the population. These foods now account for 57% of the adult diet and 66% of adolescent food intake. The health issues in later life are already filling up British hospitals and soak up two thirds of the health budget.

something to think about

Big Food’s Big Secret

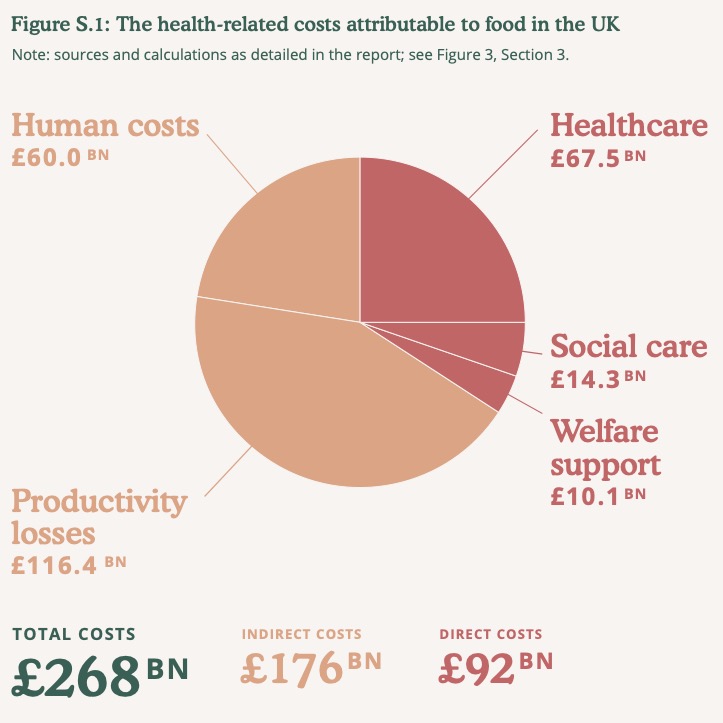

The UK government spends more than GBP 90 billion a year treating chronic food-related illness, according to the Food, Farming & Countryside Commission (FFCC). Researchers estimate that investing half that sum would be enough to make a healthy diet accessible to everyone living in the British Isles. The full extent of the damage caused to the UK economy by a dysfunctional food sector is GBP 268 billion pounds a year, taking lost productivity and early mortality into account, FFCC warns.

The Food, Farming & Countryside Commission is an independent charity, set up in 2017 to inform and extend public involvement in ongoing discussions about food and farming. Using government data as a starting point, FFCC argues that it would be significantly cheaper to produce healthy food in the first place. More to the point, it is not an option to go on footing the bill for damaged public health resulting from the commercial sector’s activities. There is simply not enough money in the kitty and time is running out.

Researchers took into account government estimates of productivity and lost earnings arising from chronic illnesses. These indirect costs are borne by a range of actors in the economy, such as local government departments. Such costs are real expenditure, but the total figure is not recorded as a single aggregate figure. When combined with the initial figures, the result is a more imposing figure and looks like figure S1.

The direct costs (in red) are existing government data; indirect costs (in orange) indicate the economic impact associated with the prevailing levels of unemployment and early mortality. Like the submerged part of an iceberg, we ignore these costs at our peril.

Working with indirect costs opens the door to accusations of misinterpretation, but economists have worked hard to establish methods that can avoid serious pratfalls. Healthcare is supported by a wide range of funding sources, from government down to private individuals. The money is real enough, even when it comes from private individuals. It just becomes harder to count. There are times when budgets for nearby or related units will be skimmed to meet ad hoc requirements. Welcome to the economists’ underworld, where early retirement due to ill health is just another negative variable.

The real cost of doing nothing

The food industry is making more people ill with processed foods than its management would ever admit, according to the Food, Farming and Countryside Commission. Researchers put the cost of chronic illness to the UK economy at GBP 268 billion. (https://ffcc.co.uk/publications/the-false-economy-of-big-food)This figure is four times the cost of fixing the problem, the report’s authors estimate. The opening statement reads like this:

New analysis commissioned by the Food, Farming and Countryside Commission (FFCC) has found that the costs of Britain’s unhealthy food system amount to £268 billion every year – almost equivalent to the total annual UK healthcare spend.

The report by Professor Tim Jackson provides the first comprehensive estimate of the food-related cost of chronic disease, caused by the current food system. The analysis combines direct costs – the costs paid for from the public purse – including healthcare costs, social care costs and welfare, and indirect costs – costs that don’t show up in government accounts – which are productivity losses and human costs.It concludes that £268 billion is the food-related cost of chronic disease in the UK – calculated by combining healthcare (£67.5bn), social care (£14.3bn), welfare (£10.1bn), productivity (£116.4bn) and human cost (£60bn) of chronic disease attributable to the current food ecosystem.

The report makes the case for a new economy of food, anchored in three key principles:

- the right of every citizen – irrespective of class, income, gender, geography, race or age – to sufficient, affordable, healthy food;

- a regulatory environment which curtails the power of Big Food, promotes dietary health and halts the rise of chronic disease;

- a financial architecture that redirects money away from perverse subsidies and post-hoc damage limitation, towards preventive healthcare and the production of sustainable, nutritious food.

Pink, salty and out of stock

The UK’s high spending foodies have been facing empty shelves, where they would normally find taramsalata. The strike action at a Bakkavar factory in Lincolnshire has successfully kept the salty pink dip out of big name retailers, including Waitrose, Sainsbury and Tesco. These industry heavyweights will get their on back on all those involved in due course — and reduce dependency on Bakkavar by recruiting other suppliers. Here is how the BBC covered the story.

Animal intake of alcohol wider than previously assumed

A number of scientific journals are running stories in their November issues about species that routinely consume alcohol as a part of their diet. Naturalists argue that it would be strange if animals were to avoid naturally-occurring sources of alcohol, such as rotting fruit. The topic got a fresh airing in specialist titles, such as Science Daily or the news pages of Phys.org, as well as UK dailies such as The Independent and The Guardian.

The impetus for the current editorial interest comes from Trends in Ecology and Evolution. The journal collates behavioural observations from past years, to make a strong argument for removing anthropocentric assumptions about alcohol and the routine overlooking of certain aspects of dietary intake in wild populations. For instance, levels of Alcohol By Value (ABV) can top 10% in over-ripe palm fruit, while ethanol can be routinely detected in 29 of Costa Rica’s 37 fruits routinely eaten by the country’s frugivores.

Answer to a pilgrim’s prayer

Good news from the French government’s fishing watchdog, IFREMER. Fishing has re-opened for scallops for the inshore fleets of Brittany and la Baie de Seine which leads to the estuary of the river Seine and the docks of Le Havre, Rouen and Paris. The French scallop fishery closes in April and stays closed until the shellfish have finished breeding. The good news for the inshore fishermen is that IFREMER estimates that there are 64,000 tonnes of mature, saleable scallops to be caught this season. More good news, this is no flash in the pan: the numbers of young scallops that will mature over the coming year will do more than just replace their predecessors, they will swell the ranks of adult scallops.

This is a ringing endorsement for a fishery protection policy that was unpopular ten years ago, but which can now produce live data to prove its efficacy. It bears witness to the fact that if wild populations are given the space and time they need to recover and breed, there is a future for all concerned. Original documentaation (in French) here.

Waiting for salvation

[Please note that this article was published in September 2024] All around the Mediterranean and across southern Europe, thousands of communities are waiting for this year’s olive crop to be milled. Until this year’s production is ready for packing, no new business can be written: there are no reserve stocks available. Every last litre has been sold and there will be no olive oil to sell before the first deliveries of the new crop year reach the market.

For months bulk olive oil prices have been sky high. As recently as August, some desperate buyers in Spain were paying almost 7,000 Euros a tonne for low-grade lampante that would normally have been a fraction of today’s prices. In August, the Spanish industry was forecasting a crop of 1.4 million tonnes of olive oil this year. This “business as normal” bravado is misplaced, since hot weather in the final weeks before the crop is gathered will affect the moisture content and can reduce the yield. In previous years, yields of 20% were average: but until this year’s crop reaches the mills, there is no reliable way of predicting finished tonnages. However, apart from wildfires, there is probably not a lot of additional damage that the environment could inflict on the nation’s olive groves.

The Spanish government is responding to the crisis by cutting VAT on olive oil from 5% to 4%, with effect from 2025. Consumers have seen retail olive oil prices rise from around EUR 3 / litre two or three years ago to hover around EUR 10 / litre now. The unthinkable is happening and Spanish consumers are buying sunflower oil instead of olive oil for home use. Since many households buy cooking oil in small quantities very often, Spaniards have suffered more from the rising prices than elsewhere in Europe. This is because most European retailers place huge orders immediately after the harvest is in, to cover the coming 12 months sales. This fixed price for the year means that retail bottle sizes can have stable prices for the duration, although there is a temptation for retailers to raise olive oil prices anyway, pushing up their margins.

Spain has imported 20,000 tonnes of olive oil this crop year, bringing Spanish consumer consumption and industry intake to a total of 100,590 tonnes. Bottler stocks in August were at an all-time low of 131,740 tonnes with a further 138,660 tonnes held by co-operatives and millers. Total production at the close of this crop year is expected top 820,000 tonnes, making it a poor year. An average season these days would be somewhere between one and two million tonnes of oil.

This year saw a closing of the gap between Extra Virgin Olive Oil (EVOO) and cheaper grades. Paradoxically, strong demand for better grades meant that the market was picked clean, leaving mainstream buyers to pay more for lower quality grades because that was all there was left. Formerly used to fuel oil lamps, as the name suggests, today lampante refers to oil that needs work to return it to an edible grade. This means that lampante has a limited number of takers, since the consignment will need to go to a refinery, adding to the cost and commercial risk.

BTOM: the story so far….

In the beginning was a grand vision for international trade, but no-one was ready to commit it to paper. So the great and the good met and agreed that: “…we outlined how our proposals sought to balance the need for effective border controls with the need to support businesses with import processes that are as simple as possible.” (https://www.gov.uk/government/publications/the-border-target-operating-model-august-2023/the-border-target-operating-model-august-2023) It may not have been a properly constructed statement of the BTOM”s purpose, but the great and the good can get away with shit like that because it goes down well at party conferences. “We explained that with our new approach, we would harness our new freedom to set our own border policy and integrate the technological transformations set out in our 2025 UK Border Strategy.”

Stuff like this costs money, so the great and the good consulted vets and food safety experts. These wise folk gave detailed technical answers that the great and the good could not follow. So instead, they devised a Brexit border tax to bring some money in and hoped that no-one would notice. Now read on…

Delivering results?

Turn the clock back to 2013 and the UK was divided over its membership of the European Union. Given the vehemence of the anti-EU campaigners, buoyed up with sympathetic media treatment, the 4% majority in 2016 was hardly a ringing endorsement for such a major change. The most memorable slogan of the time was “Brexit means Brexit.” Not surprisingly, there were also opportunities to use Machiavellian creativity to plug gaps in the Leave campaign.

It was a time in British politics when the civil service was flexing its muscles and in a position to engineer bids for power with a free hand, actively encouraged by Tory grandees like Francis Maude. Running the Cabinet Office, Maude had a new vision for the Civil Service, which was going to be set free from such tawdry constraints as public service: it was to be redefined and rewritten using People Impact Assessments (PIAs). The Cabinet Office led the way, setting up hybrid public/private joint ventures and mutuals in a bid to gain the best of both worlds, so to speak. These were not just government departments on steroids, these were new power structures of a sort that could be presented as a public service and a commercially savvy business at the same time.

The first employee-driven joint venture was the Behaviour Insights Team (often referred to as “the nudge unit”) which opened for business in March 2013. Here is what was said at the time (https://www.gov.uk/government/news/government-launches-competition-to-find-a-commercial-partner-for-the-behavioural-insights-team):

“The government’s Behavioural Insights Team will take its first step to becoming a profit-making joint venture today as the Cabinet Office launches a competition to find a commercial partner for the business. Less than three years after it was set up in the Cabinet Office the team is the first policy unit set to spin off from central government. This has been employee-led as the staff of the BIT have driven the process and will continue to run the organisation.

“The team was established to find ways of encouraging, supporting and enabling people to make better choices for themselves. Since then it has delivered rapid results – identifying tens of millions of pounds of savings, spreading understanding of behavioural approaches within government, and developing a reputation as a world leader in its field. Demand for its services from within government, the private sector and foreign governments has grown significantly.”

The decade was to see a blurring of the distinction between public servant and executive power. If political factions ever needed to inject reliable, hand-picked people to oversee critical functions in the political process, a joint venture with a government department takes a lot of beating.

Networking and data services have been at the heart of a number of government joint ventures, with the government’s 25% stake being sold off at the end of the first ten years. So it was that the French business Sopra Steria bought out the Cabinet Office’s stake in Shared Services Connected Ltd in October 2023. Here is what they said at the time:

“The transition from joint venture to wholly owned subsidiary will not affect the management, employees, clients, or services of the business, which has delivered significant savings and value for money for the taxpayer.

“Since Sopra Steria founded the company with the Cabinet Office in 2013, SSCL has become the largest provider of critical business support services for the UK Government, Ministry of Defence, Metropolitan Police Service, and the Construction Industry Training Board (CITB), delivering shared services at scale.”

It is not uncommon for IT suppliers to be over-confident about their system’s ability to cope and there are signs that all is not well at the points of delivery in the UK. Dover issued a note to port users in early June, seeking details of operational failures with BTOM. Invoicing for the Brexit border tax has been plagued with errors, including double-billing.

Ten years ago, there can be little doubt that Francis Maude knew and understood the Sopra Steria motto of the day: “The world is how we shape it.” Reality has since dawned on the management and it has been withdrawn.

Down time

DEFRA has a problem, but is saying nothing that will help the situation. The release is a classic of its genre and a PDF of it can be downloaded here. The first paragraph is fatuous and the second is nonsense. They haven’t got a clue and but won’t say so.