This week the UK delivered the world’s first fully digitally documented consignment of goods. Burnley engineering firm Fort Vale became the first UK exporter to put electronic documentation on an equal footing with paper forms. This was made possible by the Electronic Trade Documents Act (ETDA), which came into force on Wednesday. To be sure, the goods involved were not food products, but Urban Food Chains wanted to mark the occasion anyway. Here’s a link to the gov.uk statement.

Hard cheese

Irish dairy farmers are seeing huge falls in demand and output in the wake of Brexit. The Irish Creameries’ Suppliers Association ICMS this week revealed that this was an ongoing situation and not a passing phase. Not surprisingly, the ICMS has some very substantial members who between them exported more than 80,000 tonnes of block Cheddar a year to the UK. Allow 13 tonnes of milk to make a tonne of Cheddar and store it for a year or two at a creamery, and it adds up to a significant business commitment.

Those with long memories will remember former farm minister Liz Truss regaling the 2014 Tory party conference with a hatchet job on British cheese imports. Surprisingly little change from today’s outbursts, really. Shows how little she learnt at DEFRA.

For a future reading list

In a few decades, once political sensitivities have healed, there may be a generation that seeks to make sense of the current chaos. Former public policy editor of the Financial Times, Peter Foster, has written a contemporaneous account of the poor policy making that has dogged the Brexit negotiations and beyond. What Went Wrong With Brexit is published by Canongate. Visitors to Google Books will also find a sample chapter and a download link for purchases.

Seasonal footnote 160923

At the beginning of the week, there were clusters of ripe blackberries on the back of the estate with a sweet sugary burst of flavour as they yielded to peckish hands. After a long stretch of hot weather, the season changed almost imperceptibly: the result was a distinctly vinegary note in the previously sweet taste. The following day, distinctly chillier, dawned to reveal the previously sound fruit had rotted off.

A work in progress?

As the world’s most recent third country, UK food exports are at the receiving end of thorough checks on entry to the EU. All animal products are allocated risk levels and inspected accordingly; plant material undergo a parallel set of phytosanitary (plant health) checks. For UK exporters, the administrative overheads of complying with food safety standards were a known quantity long before the January 2021 transfer to third country status when UK shipments were routinely checked in Border Control Posts (BCPs).

The UK has yet to carry out its longstanding commitment to implement a mirror image system with the same inspection protocols for food shipments coming into the UK. Until that happens, Brexit is no more than a work in progress, not a done deal.

At the time of writing, the UK government is poised to kick border checks on into the long grass for the fifth time, delaying the full complement of checks until autumn 2024. This should come as no surprise, given the gaps in government resources.

Westminster is wrestling with a structural shortage of vets who are authorised to issue valid health declarations. This was a known issue in 2017 when a House of Lords select committee warned of a vet shortage, among other things, in its report Brexit: plant and animal biosecurity Over the past few years there have been a number infrastructure modifications at UK ports to house BCP facilities. The situation is complicated by the fact that around the UK not all ports are in public ownership and many have hybrid management frameworks. For some, the fabric of the port is its capital, meaning that a parliamentary bill may be required to underwrite loan capital for major infrastructure investments. This is only one factor among many that has cooled the government’s will and ability to act, however.

The UK food industry is caught up by its own reluctance to make the transition to full food safety checking at internal borders. This is not a public health issue so much as a tangle of red tape and knowledge gaps. At any given time of the day or night, there will be dozens of lorry movements up and down the country, heading for Northern Ireland. Leaving aside the unionist arguments against having a border check where none should be required, there is potentially a grittier problem to resolve.

There is a lack of old-fashioned stock control clerks with previous experience of customs documentation. The real problem is that the documentation travelling with a load is closer to a customs valuation than a handlist for whoever has to unpack the roll cage when it arrives instore. The stock in trade of an RDC (Regional Distribution Centre) is a loaded roll cage with dozens of SKUs, more or less stacked in the order they were picked. This is adequate for England and Wales, but is not a promising start for goods which may need to be inspected on a line by line basis in a customs shed.

The rules for calculating a customs valuation are clear and there are a number of ways in which a customs valuation may be arrived at, each with its own methodology. Think of the process as HMRC making a window into a retailer’s accounting system and then discovering anomalies with earlier figures. These could arise from the ways in which shelf money is managed or have an innocent explanation, but making a case to HMRC for a wide gap between a low customs valuation and a full retail price is not what people want to spend time on just now, if at all.

The additional cost of physical checks just adds to the awkwardness of the situation. The UK government is preparing to run documentation checks on inbound animal products for just over GBP 30, but is fighting shy of publishing a price list that would put physical checks into the six or seven hundred pound bracket. These inspection costs would feed directly into the import VAT calculations, pushing up the final figure.

The uncompromising attention to detail and the time these checks will add to operating costs — meaning that they should be blamed on a new incoming government in the wake of a general election. This morning’s BBC news carried an item to the effect that MPs standing down at the next election, or defeated at the ballot box should continue to be paid for four weeks instead of the current fortnight. Someone in Westminster is reading the writing on the wall.

Value or price?

Today’s On Your Farm came from Yew Tree Farm, Bristol’s last city farm. Third generation farmer Catherine Withers faces existential challenges to a business that has adapted to extensive and rapid change, but is on the point of losing access to land that is vital to its survival. Part of a site of Scientific and Conservation Interest, the farm should have been spared the predatory attention of a local property developer.

Instead, acres of hay and winter feed once intended for Catherine’s dairy herd is under lock and key. The tenancy on the field concerned was terminated in favour of a planning proposal for 200 homes that has yet to be agreed. When the BBC visited, the hay in the field was ready to be cut and the livestock would have been sure of winter sustenance. However, Catherine is kept away from her crop by a heavy padlock on the gate. Being able to see the crop but not gather it in just adds injury to insult.

Elsewhere on the farm, another tenancy on a field adjacent to a local council crematorium is set to end, as the town hall plans to extend the amenities for its residents. Again, it is the dairy cattle that will lose out. Catherine has a small dairy herd, as well as outdoor pigs: she also grows vegetables, which she can sell to local residents within walking distance of her farmhouse. Bristol used to have more than 30 farms within its boundaries: as the city’s only remaining farmer, Catherine is something of a local hero, not just to her customers.

Yew Tree has a high proportion of ancient meadow in its grazing, an irreplaceable asset that has been quietly sheltering threatened flora and fauna for centuries. Its value to Bristol is incalculable, but depends on being an integrated space, across which wildlife can roam. The shift from viable and productive to long term decline is an ever-present threat and determined by factors that neither Catherine nor her many supporters can control.

Listen to the programme while it is available on the BBC Sounds website. It raises questions for all of us, regardless of whether we live in a city or a rural area.

Of Brexit and dogs’ dinners

For years the Common European Tariff has ensured that imports of third country pet food have been taxed heavily at the border. Duty of up to EUR 948/tonne is added to the invoice price of any dog food that might cross the EU border. The exact rate depends on the product’s composition. During the UK’s years as an EU member state, UK customs officials were ready and waiting to do their bit to ensure that third country pet food did not arrive unchallenged by officialdom. Needless to say, a duty regime as strong as this has successfully excluded products which faced duty out of all proportion to their price.

That was then and this is now. We have been through Brexit, which remains a work in progress. As the world’s most recent third country, has the UK risen to the challenge and opened the gates to imports of third country pet foods? Have the punitive levels of duty been dismantled in the UK’s Schedule XIX? Guess.

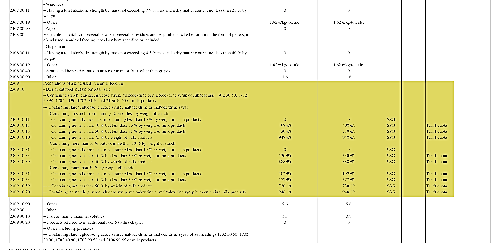

The table shows the current duty rates for goods covered by customs code 2309 10 – Dog or cat food, put up for retail sale (highlighted in yellow). Click the image to download the complete document. Betweentimes, the tariffs have been redenominated in GBP at an exchange rate of around 85 pence to the Euro. Depending on the formulations, these products face duty up to GBP 805/tonne and are essentially unchanged. Given the stated aim of Brexit to boost trade with the rest of the world, it would have been simple to edit the twenty or so tariff lines, setting them to zero, job done.

The irony of the Brexit debacle is that it neither achieved any of its wild dreams, nor were any logical adjustments carried out to meet Brexit’s stated aim of trade liberalisation. The Common European Tariff (CET) was drafted as a blunt instrument to suggest that the cost of subsidised products under the Common Agricultural Policy (CAP) could be calculated with a degree of accuracy. The CAP has evolved since these agri-tariffs first saw the light of day, losing much of their relevance in the process.

But let us start at the beginning. At the risk of stating the obvious, the UK chose to become a third country, in the EU sense of the term, used to refer to non-members of the EU. The Common European Tariff is built on this “us and them” view of the world. This detailed document was structured for this purpose and no other. The UK has adopted it with a surprisingly low number of often symbolic modifications, leaving the original EU intent intact.

It comes as a bit of surprise to learn that such humble products as dogs’ dinners command such high levels of duty. Animal foods are a downstream activity that typically draw in by-products from the manufacture of more lucrative goods. Industrialised food production brings with it a higher degree of homogenisation in both ingredients and by-products. There is a business case for ensuring that all available downstream ingredients are incorporated in some sort of secondary product, even if it only serves to dodge the cost of waste disposal. Indeed, the tipping point between a positively-priced ingredient and the operational cost of managing indeterminate mush is a crude measure of technological sophistication. That said, it will be searched for more closely in company accounts than production lines.

Working with documents generally supposedly means keeping one’s hands clean. This is a moot point, which can be illustrated with a straightforward example: tariff item 0208 40 10 is whale meat, once a common ingredient in pet foods many years ago. Third country whale meat is taxed at 6.4% ad valorem. There is a case to be made for taxing it mercilessly, on environmental grounds. There is a procedural problem with this, however, since the World Trade Organization will only cut tariffs, but not raise them. Since the WTO decisions are based on consensus, any attempt to obstruct international trade in whale meat will be systematically be blocked by Japan, Iceland and the Faroes. There are similar problems, on a smaller scale, with a 6.4% ad valorem duty on tariff item 0208 90 70: frogs’ legs.

Equivalence is not the same

The familiar CE quality mark is far more important than it might appear at first sight. It is the first line of defence in meeting product liability requirements. The presence of the CE graphic assures consumers that the product concerned meets all the EU safety regulations and can be sold legally within the EU. CE stands for conformite europenne (conforms to European regulations).

At some point in the Brexit planning stages, someone had the bright idea of devising a British equivalent to reassure consumers that post-Brexit British goods complied with British legal requirements. It would have been better if someone had spotted the looming problem and canned the UKCA lookalike quality mark before releasing it on an unsuspecting public. No such luck, it just gets worse.

The UK parliament’s control of the quality mark and its use is limited to, well, the UK. It has no status or relevance in continental Europe, for which it was intended. Brussels does not recognise the mark, nor is there any reason why it should. UK plans to drop accreditation for the original CE mark have suddenly been put on hold, as businesses complained that they genuinely need the CE mark for their export goods. As part of the CE accreditation, a substantial chunk of EU law, previously earmarked for dumping, will now have to be kept on the statute book for the UK’s claim to continue issuing CE marks to be valid.

It is the kind of own-goal for which Brexit is becoming infamous. There is the mild embarrassment of having to retain EU laws that some in government wanted to clear out so as to make room for other things. The requirement to organise and fund two separate product certification applications, not to mention the additional testing fees, has unsettled many businesses, faced with having to pay twice. More to the point, UKCA cannot replace the CE mark outside UK borders, nor will Brussels ever recognise it.

Follow this link for a guide to UKCA and CE requirements.

Grocery Code Adjudicator: inaction in action

Not long ago the Grocery Code Adjudicator’s office published its report for the past year. The reality behind the lukewarm prose is more disturbing than might first appear: the complaints raised are predictably familiar and there are multiple labels for what appear to be depressingly perennial abuses. More to the point, given the confidentiality of the process, it is not possible to determine an order of magnitude for the sums involved. This is not just a nice-to-have ballpark figure, but a true measure of the scale of a continuing problem.

The presentation and figures can be downloaded here. There are a good two dozen descriptions for the issues that have been raised by suppliers. The rates of change given for year-on-year complaint numbers are within five or six percent of the previous year, which is supposed to mean that everything is under control. The message is a very firm “…nothing to be seen here. No, really, THERE IS NOTHING to be seen here…” Yet the sort of practices that suppliers are complaining about would normally merit criminal investigations. Or would insisting on the letter of the law just put suppliers out of business?

Those who have been in the food industry for years will have acquired a collection of tales of extortion and graft that at first hearing seem overstated, but which become hard to ignore or dismiss. A lifelong food industry veteran put it this way: “The multiples have been running circles round the government for years. It’s been going on for decades. These days retailers are so used to demanding money left right and centre that it’s hard to know how they keep track of their real costs.”

It is well nigh impossible to assign an order of magnitude or give a steer on how serious the ongoing abuse might be in the grocery trade. Let us be as circumspect as possible in unpacking this one. Let us assume, for instance, that there is only one instance of a dispute under any of these headings and that the percentage figure, rather than referring to a case load, is a crude measure of the sums of money involved. Anything bolder than that would suggest a totally compromised food industry. Don’t rule that out, by the way.

Now take the following two GCA sub-headings as examples:

(a) Requests for payments to keep your existing business with a Retailer (pay to stay)

(b) Requests for lump sum payments relating to Retailer margin shortfall not agreed at the start of the contract period.

These both look suspiciously like blackmail, but let’s try to estimate an order of magnitude for these actions. Shelf money demands are usually based on a fixed sum per SKU per product range, for a listing across two to three hundred sales outlets. To get an idea of the sums of money that can be involved, assume the product concerned costs one pound and comes in five flavours and three pack sizes (sub-total 15 SKUs). Pull a pay to stay value out of thin air of GBP 5000 for each SKU listing across 250 sales outlets, fifteen SKUs times GBP 5000, guesstimate budget GBP 75000. If the retailer has a markup of 20p, the pay to stay demand is equivalent to a supplier “giving” 375,000 units of product (20p times 375,000 = GBP 75,000). While it is not unheard of for retailers to withhold all or part of an invoice, it is not in the suppliers’ interest to hand over lorryloads of product, which will earn the retailer the full retail price at the checkout: literally having their cake and eating it.

Given that a hypermarket can easily have up to 20,000 food SKUs, not counting own-label lines, you could end up with an aggregate demand for shelf money running to millions of pounds if they were all to be counted towards a shelf money Christmas list. Given that these are very large wadges of money to conceal on a balance sheet, our imaginary retailer will probably need all the accounting strategies they can think of to hide the true state of the cash flows. Again, to avoid overstatement, we will assume that each heading only refers to a single instance of a commercial abuse.

In choosing a theoretical sum of GBP 5000 per SKU for shelf money, this could be seen as an exaggeration. However, one simple factor ramping up shelf money demands is the simple proliferation of the high street formats for mainstream food retailers. It is highly improbable that a retail multiple would forego an established shelf money framework when opening high street stores. However, competing convenience stores simply do not have the kind of clout that a major multiple can bring to bear on brand owners in a store format that leans heavily on established brands.

The office of Grocery Code Adjudicator was set up about 20 years ago and spent about half that time building up its role as a trusted arbiter, a lap dog rather than a watchdog. It is hard to imagine that it has done more than scratch the surface of the very real problems facing food manufacturers and brand owners in their dealings with a clique of very powerful customers, the multiple retailers.

Pounds, pence and Euros

If current headlines (week 24, 2023) about the turmoil in the Conservative party appear serious, wait until the parlous state of the UK’s unfinished Brexit arrangements come home to roost. History will judge those responsible, but the UK population will pay the price. Having copied and pasted the Common European Tariff into the UK economy, ministerial hands have been fiddling with some of the detail, but not with any visible signs of understanding what they were about.

As one might expect, the Common European Tariff is haunted by a number of ghosts in the machine. These are mainly mechanisms that protected former cornerstones of the Common Agricultural Policy from third country imports. With some dating back to the 1970s, these tariffs were supposed to make subsidised EU agricultural products competitive on the internal market against third country goods. Many of the tariffs are ad valorem percentages, but most of the politically sensitive sectors supported by the CAP are made up of an ad valorem percentage and a flat rate payment per 100kg in Euros, redenominated in GBP.

Third country olive oil arriving in the EU still faces a flat rate duty of EUR 124.50 per 100 kg. For some years now, there have been trade deals with third countries such as Tunisia, which establish a duty-free quota for EU packers. This olive oil can then be traded freely within the EU.

Under Rules Of Origin (ROO), however, any third country olive oil arriving in the UK is liable for duty at GBP 104 pro rata in blends, converted into sterling at around 85p to the Euro. Now the UK has no indigenous producers of olive oil to protect from competitive pricing of third country oils and ministers could have cheerfully set the duty to zero.

All the schedule XIX money values appeared in Euros before Brexit, as they did when the document first appeared in the summer of 2018. For its UK enquiries, HMRC works in pounds and pence. The transfer of Schedule XIX to Sterling was carried out by the WTO (World Trade Organisation) but there remain a lot of unresolved issues that will take a lot longer to resolve than Brexit. With more than 160 members, the WTO’s insistence on consensus makes bluster and confrontation counter productive. Brexit negotiations were shot through with contempt for consensus on the British side. In Geneva it doesn’t wash.