For years the Common European Tariff has ensured that imports of third country pet food have been taxed heavily at the border. Duty of up to EUR 948/tonne is added to the invoice price of any dog food that might cross the EU border. The exact rate depends on the product’s composition. During the UK’s years as an EU member state, UK customs officials were ready and waiting to do their bit to ensure that third country pet food did not arrive unchallenged by officialdom. Needless to say, a duty regime as strong as this has successfully excluded products which faced duty out of all proportion to their price.

That was then and this is now. We have been through Brexit, which remains a work in progress. As the world’s most recent third country, has the UK risen to the challenge and opened the gates to imports of third country pet foods? Have the punitive levels of duty been dismantled in the UK’s Schedule XIX? Guess.

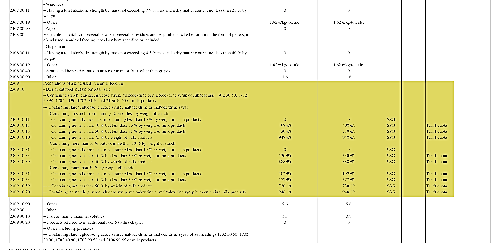

The table shows the current duty rates for goods covered by customs code 2309 10 – Dog or cat food, put up for retail sale (highlighted in yellow). Click the image to download the complete document. Betweentimes, the tariffs have been redenominated in GBP at an exchange rate of around 85 pence to the Euro. Depending on the formulations, these products face duty up to GBP 805/tonne and are essentially unchanged. Given the stated aim of Brexit to boost trade with the rest of the world, it would have been simple to edit the twenty or so tariff lines, setting them to zero, job done.

The irony of the Brexit debacle is that it neither achieved any of its wild dreams, nor were any logical adjustments carried out to meet Brexit’s stated aim of trade liberalisation. The Common European Tariff (CET) was drafted as a blunt instrument to suggest that the cost of subsidised products under the Common Agricultural Policy (CAP) could be calculated with a degree of accuracy. The CAP has evolved since these agri-tariffs first saw the light of day, losing much of their relevance in the process.

But let us start at the beginning. At the risk of stating the obvious, the UK chose to become a third country, in the EU sense of the term, used to refer to non-members of the EU. The Common European Tariff is built on this “us and them” view of the world. This detailed document was structured for this purpose and no other. The UK has adopted it with a surprisingly low number of often symbolic modifications, leaving the original EU intent intact.

It comes as a bit of surprise to learn that such humble products as dogs’ dinners command such high levels of duty. Animal foods are a downstream activity that typically draw in by-products from the manufacture of more lucrative goods. Industrialised food production brings with it a higher degree of homogenisation in both ingredients and by-products. There is a business case for ensuring that all available downstream ingredients are incorporated in some sort of secondary product, even if it only serves to dodge the cost of waste disposal. Indeed, the tipping point between a positively-priced ingredient and the operational cost of managing indeterminate mush is a crude measure of technological sophistication. That said, it will be searched for more closely in company accounts than production lines.

Working with documents generally supposedly means keeping one’s hands clean. This is a moot point, which can be illustrated with a straightforward example: tariff item 0208 40 10 is whale meat, once a common ingredient in pet foods many years ago. Third country whale meat is taxed at 6.4% ad valorem. There is a case to be made for taxing it mercilessly, on environmental grounds. There is a procedural problem with this, however, since the World Trade Organization will only cut tariffs, but not raise them. Since the WTO decisions are based on consensus, any attempt to obstruct international trade in whale meat will be systematically be blocked by Japan, Iceland and the Faroes. There are similar problems, on a smaller scale, with a 6.4% ad valorem duty on tariff item 0208 90 70: frogs’ legs.

Leave a Reply